Was ist Gehaltsabrechnung? Ein umfassender Leitfaden für Personalfachleute

Faktoren wie weit entfernte, verteilte Teams und wechselnde Vorschriften machen die Gehaltsabrechnung komplexer. Ohne die richtigen Systeme führt diese Komplexität zu Fehlern, deren Behebung teuer ist.

Aus diesem Grund ist es wichtig, die Grundlagen der Gehaltsabrechnung genau zu verstehen und effiziente Prozesse zu ihrer Unterstützung aufzubauen. Mit dem richtigen Ansatz und dem richtigen Tech-Stack können Sie die Genauigkeit verbessern und sicherstellen, dass die Mitarbeiter jedes Mal korrekt und pünktlich bezahlt werden.

In diesem Leitfaden wird erklärt, wie die Gehaltsabrechnung funktioniert, und konzentriert sich dabei auf Unternehmen in den Vereinigten Staaten. Es enthält Definitionen, Komponenten, Schritte, häufige Fallstricke und Tools. Es enthält auch Links zu weiterführenden Ressourcen, wo Sie sie möglicherweise benötigen.

💸 Machen Sie die Gehaltsabrechnung zum Kinderspiel

Die Gehaltsabrechnungsfunktionen von Leapsome ermöglichen es HR-Teams, Mitarbeiterdaten zu zentralisieren, Gehaltsabrechnungszyklen zu automatisieren und Gehaltsabrechnungsberichte zu erstellen.

👉 Machen Sie eine Produkttour

Was ist Gehaltsabrechnung?

Die Gehaltsabrechnung ist der Prozess, bei dem Mitarbeiter für ihre Arbeit entschädigt werden. Diese einfache Definition spiegelt jedoch nicht die Komplexität der Gehaltsabrechnung wider. Die Gehaltsabrechnung umfasst administrative und Compliance-Aufgaben wie Erfassung der geleisteten Arbeitsstunden, Berechnung des Lohns, Verwaltung von Abzügen und Leistungen, Bearbeitung von Steuereinbehaltungen, Durchführung von Zahlungen und Aufrechterhaltung der Richtigkeit Aufzeichnungen im Einklang mit den Arbeits- und Steuervorschriften.

Die Gehaltsabrechnung wirkt sich auf Finanzen und Compliance aus, und es kommt darauf an, alles richtig zu machen. Ungenauigkeiten können sich negativ auswirken das Mitarbeitererlebnis und kann kostspielig werden Gehaltsabrechnungen außerhalb des Zyklus. Fehler können auch die Moral stören, Bußgelder nach sich ziehen und Prüfungen auslösen. Aus diesem Grund setzen viele Unternehmen auf Gehaltsabrechnungssoftware um den Prozess zu rationalisieren und menschliche Fehler zu reduzieren.

📚🌟 Willst du tief in die Gehaltsabrechnung eintauchen? Erkunden Sie unsere Ressourcen zur Gehaltsabrechnung:

✨ Lesen Sie unsere Schritte Schritt für Schritt Vorbereitung der Gehaltsabrechnung Leitfaden, um mehr über den Prozess der Gehaltsabrechnung zu erfahren.

✨ Lesen Sie weiter oben Gehaltsabrechnungstrends des Jahres, um der Konkurrenz und der Konkurrenz immer einen Schritt voraus zu sein.

✨ Erfahren Sie, wie Sie manuelle Arbeit reduzieren und Ihren Gehaltsabrechnungsworkflow beschleunigen können mit unserem Automatisierung der Gehaltsabrechnung Führer.

✨ Finden Sie mit unserem Erklärungstexter heraus, welches Zahlungsintervall für Ihr Unternehmen geeignet ist Gehaltsabrechnungszyklen.

✨ Bewerten Sie die Gehaltsabrechnung Ihres Unternehmens mit unserem Artikel über Kennzahlen zur Gehaltsabrechnung.

✨ Organisieren Sie sich mit unserem kostenlosen, herunterladbaren Vorlage für einen zweiwöchentlichen Gehaltsabrechnungskalender.

✨ Erfahren Sie, wie Sie ein neues Gehaltsabrechnungssystem in Ihrem Unternehmen mit unserem umfassenden Implementierung der Gehaltsabrechnung Führer.

✨ Bringen Sie Ihre Terminologie mit unserer Aufschlüsselung gängiger Begriffe auf den neuesten Stand Bedingungen für die Gehaltsabrechnung.

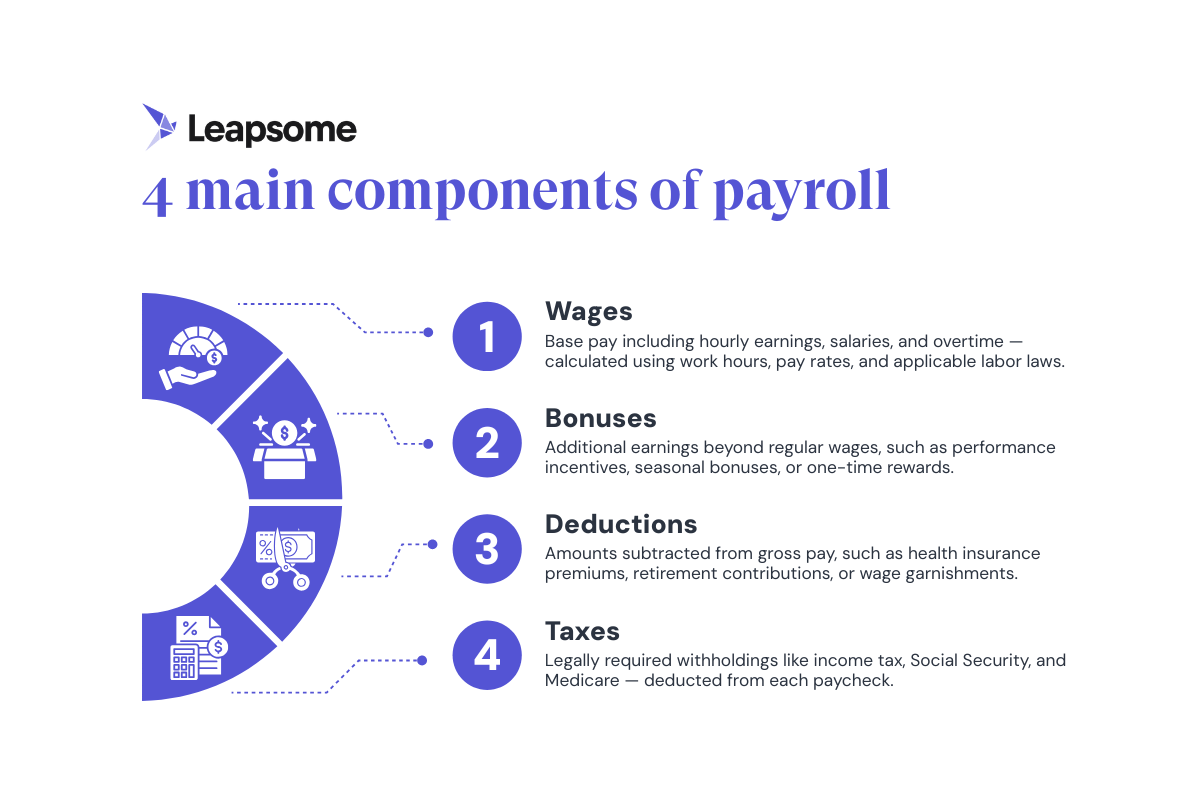

Was sind die Hauptbestandteile der Gehaltsabrechnung?

Verschiedene Faktoren beeinflussen den Betrag, den ein Mitarbeiter auf seinem Gehaltsscheck erhält, darunter:

Komponente #1: Löhne

Löhne bilden die Grundlage der Gehaltsabrechnung. Dazu gehören Stundenlohn, feste Gehälter und anrechnungsfähige Überstunden. Die Art der Vergütung — Stunden- oder Lohnvergütung — wirkt sich darauf aus, wie die Löhne berechnet werden. Arbeitgeber berücksichtigen im Allgemeinen die geleisteten Arbeitsstunden, den vereinbarten Lohnsatz und die entsprechenden Überstundenregeln gemäß den geltenden Arbeitsgesetzen.

Komponente #2: Boni

Boni beziehen sich auf Vergütungen, die über den Grundlohn hinausgehen. Diese können Folgendes beinhalten Leistungsanreize, Urlaubsboni oder andere Ermessenszahlungen. Es ist wichtig, Boni bei der Gehaltsabrechnung genau zu berücksichtigen, da sie in der Regel den Quellensteuereinbehaltungs- und Meldepflichten unterliegen.

Komponente #3: Abzüge

Abzüge beziehen sich auf Beträge, die vom Bruttolohn eines Arbeitnehmers einbehalten werden, bevor der Nettolohn ausgezahlt wird. Dazu können von den Arbeitnehmern gewählte Beiträge (z. B. zur Krankenversicherung oder Altersvorsorge) und obligatorische Abzüge wie Lohnpfändungen oder Gewerkschaftsbeiträge gehören. Arbeitgeber sollten zwischen freiwilligen und vorgeschriebenen Abzügen unterscheiden und sicherstellen, dass diese gemäß den geltenden Arbeitsgesetzen abgewickelt werden.

Komponente #4: Steuern

Die Lohnsteuer beinhaltet in der Regel die gesetzlich vorgeschriebenen Bundes-, Landes- und Kommunalsteuern. In den Vereinigten Staaten beinhalten diese in der Regel Einkommenssteuereinbehalte sowie Sozialversicherungs- und Medicare-Beiträge im Rahmen der Bundesgesetz über Versicherungsbeiträge (FICA).

Zusätzliche Überlegungen zu Gehaltsabrechnungskomponenten

Diese Liste ist nicht vollständig. Andere Faktoren, wie erstattete Ausgaben, Lohnnebenleistungen oder unbezahlter Urlaub, können sich ebenfalls auf den Nettolohn auswirken. Diese Faktoren können je nach den lokalen Gesetzen und Arbeitsverträgen aus steuerlichen oder behördlichen Gründen unterschiedlich behandelt werden.

So funktioniert der Gehaltsabrechnungsprozess

Sehen wir uns die wichtigsten Schritte der Gehaltsabrechnung, Ihre Steuerpflichten als Arbeitgeber und die häufigsten Fehler an, die Sie vermeiden sollten.

Wichtige Schritte bei der Gehaltsabrechnung

Die Gehaltsabrechnung umfasst mehrere Schritte. Fehler können sich auf Ihren Cashflow, Ihre Finanzplanung und die Moral der Mitarbeiter auswirken. Fast die Hälfte der Fachleute sagt Fehler bei der Gehaltsabrechnung schaden ihrer Zufriedenheit.

Um Sie zu unterstützen, haben wir eine leicht verständliche Gehaltsabrechnungscheckliste erstellt, die Ihnen hilft, effiziente und genaue Gehaltsabrechnungszyklen durchzuführen:

- Gründung von Gehaltsabrechnungsgrundlagen — Registrieren Sie Ihr Unternehmen bei den zuständigen Behörden. Richten Sie Systeme ein, um Einbehalte, Mitarbeiterzahlungen und Meldepflichten zu verwalten. Machen Sie sich mit den für Ihr Unternehmen geltenden Arbeits-, Steuer- und Datenschutzbestimmungen vertraut.

- Erfassung von Mitarbeiterinformationen — Sammeln Sie das Nötige Dokumentation, wie Steuereinbehaltungsformulare, Bankdaten für Direktüberweisungen und Sozialversicherungsnummern.

- Zeit und Anwesenheit verfolgen — Implementieren Sie eine zuverlässige Zeiterfassung und Abwesenheitsmanagement System.

- Nettolohn berechnen — Beginnen Sie mit dem Bruttolohn jedes Mitarbeiters und wenden Sie dann obligatorische Abzüge (z. B. Einkommenssteuer, Sozialversicherungsbeiträge) und alle freiwilligen Abzüge (z. B. Altersvorsorge oder Krankenversicherung) an.

- Gehaltsschecks verteilen — Bezahlen Sie Mitarbeiter mit der von Ihnen bevorzugten Zahlungsmethode, z. B. Direktüberweisung oder Scheck, und zwar innerhalb der von Ihrer örtlichen Gerichtsbarkeit festgelegten Gehaltshäufigkeit oder den von Ihrer örtlichen Gerichtsbarkeit festgelegten Zahlungsfristen.

- Aufzeichnungen pflegen — Führen Sie detaillierte Gehaltsabrechnungen für jede Zahlungsperiode. Bewahren Sie sie in einem sicheren, zugänglichen System auf und bewahren Sie sie für die gesetzlich vorgeschriebene Dauer auf.

- Steuern und Berichte einreichen — Überweisen Sie die einbehaltenen Steuern rechtzeitig an die zuständigen Regierungsstellen. Datei: alles erforderlich Gehaltsabrechnungsberichte genau und in Übereinstimmung mit den für Ihr Unternehmen geltenden Fristen.

✔️ Laden Sie unsere vollständige Gehaltsabrechnungscheckliste kostenlos herunter

Suchen Sie nach einer detaillierten Aufschlüsselung des Gehaltsabrechnungsprozesses? Suchen Sie nicht weiter.

👉 Jetzt herunterladen

Die Lohnsteuerpflichten von Arbeitnehmern und Arbeitgebern verstehen

Arbeitgeber und Arbeitnehmer haben unterschiedliche Lohnsteuerpflichten — und diese zu verstehen, ist entscheidend, um die Vorschriften einzuhalten und die Gehaltsabrechnung korrekt zu verwalten.

In den Vereinigten Staaten sind Mitarbeiter in der Regel verantwortlich für:

- Einkommensteuern, wobei der Betrag auf der Grundlage der in ihrem Gehaltsscheck angegebenen Informationen von ihrem Gehaltsscheck einbehalten wurde IRS-Formular W-4 (z. B. Anmeldestatus und Anzahl der Angehörigen). Die Arbeitgeber behalten diesen Betrag ein und überweisen ihn im Namen des Arbeitnehmers, zahlen ihn jedoch nicht selbst.

- Beiträge zur Sozialversicherung und zur Medicare-Steuer (FICA), die automatisch von ihrem Lohn abgezogen werden. Zum Zeitpunkt des Schreibens dieses Artikels Die Sozialversicherungs- und FICA-Beiträge der Arbeitnehmer belaufen sich auf 7,65%.

US-Arbeitgeber sind für mehrere weitere verantwortlich Lohnsteuerpflichten, wie zum Beispiel:

- Einbehaltung und überweisend Einkommenssteuern der Arbeitnehmer an die zuständigen Steuerbehörden (ohne diese Steuern selbst zu zahlen).

- Anpassung der FICA-Beiträge des Mitarbeiters.

- Zahlung von Arbeitslosensteuern auf Bundes- und in vielen Fällen auf Landesebene.

- Einzahlung aller einbehaltenen Steuern mit den zuständigen Behörden.

- Einreichung genauer Lohnsteuerformulare und Pflege gesetzeskonformer Gehaltsabrechnungen.

💡 Wir empfehlen, einen Steuerexperten zu konsultieren, um eingehendere Informationen zu Ihren steuerlichen Pflichten als Arbeitgeber zu erhalten.

Häufige Herausforderungen und Fehler bei der Gehaltsabrechnung

Fehler bei der Gehaltsabrechnung passieren, aber Wenn Sie die häufigsten kennen, können Sie sie leichter vermeiden. Hier sind ein paar, auf die Sie achten sollten — und wie Sie sie verhindern können:

Fehlklassifizierung der Mitarbeiter

Wenn Mitarbeiter fälschlicherweise als unabhängige Auftragnehmer eingestuft werden (oder umgekehrt), kann dies zu Steuerstrafen, fehlenden Ansprüchen und Problemen mit der Einhaltung der Vorschriften führen. Die Sicherstellung einer genauen Klassifizierung trägt zur Minderung rechtlicher und finanzieller Risiken bei.

Steuer- und Compliance-Fehler

Fehler wie die Verwendung falscher Steuersätze, das Fehlen erforderlicher Unterlagen oder die Nichteinhaltung der örtlichen Arbeitsvorschriften können zu Strafen führen. Halten Sie sich über die geltenden Vorschriften auf dem Laufenden und stellen Sie sicher, dass die internen Gehaltsabrechnungsprozesse korrekt und auf dem neuesten Stand sind.

Verpasste Termine

Verspätete Lohnzahlungen oder verspätete Leistungsbeiträge können zur Unzufriedenheit der Mitarbeiter und, je nach den lokalen Vorschriften, zu rechtlichen Risiken führen. Die Einhaltung eines klaren Gehaltsabrechnungsplans und die Verwendung automatisierter Erinnerungen können eine zeitnahe und genaue Gehaltsabrechnung unterstützen.

Falsche Lohnberechnungen

Fehler bei der Bezahlung von Überstunden, Boni oder Abzügen können zu falschen Zahlungen der Mitarbeiter führen. Durchführung regelmäßiger Audits und Einsatz zuverlässiger Gehaltsabrechnungssoftware kann die Genauigkeit unterstützen und das Risiko von Verstößen verringern.

Fehler bei der Dateneingabe

Veraltete Mitarbeiterdaten oder falsche Angaben können zu Gehaltsabrechnungsunterschieden führen, die einer administrativen Korrektur bedürfen. Wenn Sie sicherstellen, dass die Informationen der Teammitglieder auf dem neuesten Stand sind, können Sie das Fehlerrisiko verringern und reibungslosere interne Abläufe unterstützen.

Gehaltsabrechnungssysteme und Technologie

In den meisten Unternehmen entsprechen einfache Tabellen nicht mehr den betrieblichen Anforderungen oder den Compliance-Anforderungen. Manuelle Gehaltsabrechnungsprozesse wie diese sind für bereits überlastete HR-Teams zeitaufwändig — Über ein Drittel von ihnen waren im vergangenen Jahr mit Einstellungsstopps oder Entlassungen konfrontiert.

Eine zukunftsfähige Gehaltsabrechnungssoftware kann HR-Teams dabei helfen, Routineaufgaben zu rationalisieren und die Wahrscheinlichkeit administrativer Fehler zu verringern. Diese Tools unterstützen auch effizientere Workflows für die Berichterstattung und Analyse nach der Gehaltsabrechnung und können ein wichtiger Bestandteil Ihrer sich weiterentwickelnden Gehaltsabrechnungen sein.

Wichtige Funktionen der Gehaltsabrechnungssoftware, auf die Sie in der Gehaltsabrechnungssoftware achten sollten

Es gibt keinen Mangel an Gehaltsabrechnungssoftware Optionen auf dem Markt. Aber wie immer hängt die beste Option für Ihr Unternehmen von Ihren Bedürfnissen ab. Die folgenden Funktionen sind für die meisten modernen Organisationen nützlich:

Integrationen und HR-Kernangebote

Integriert Zeiterfassung und Abwesenheitsmanagement Funktionen machen es einfach, Arbeitszeiten und Mitarbeiterdaten mit Gehaltsabrechnungen zu synchronisieren. Besser noch, eine umfassende Personalinformationssystem (HRIS) wird es einfacher machen, Gehaltsabrechnungsinformationen zu finden, zu aktualisieren und zu analysieren und Reduziere deinen Tech-Stack.

Self-Service-Portal für Mitarbeiter

Self-Service-Funktionen reduzieren den Verwaltungsaufwand, fördern die Transparenz und fördern die Eigenverantwortung. Sie erleichtern Ihnen das Leben als Personalfachmann erheblich und helfen Teammitgliedern, jederzeit auf wichtige Informationen zuzugreifen.

Funktionen zur Mitarbeiterunterstützung

Wenn Sie Ihre Personalprozesse zentralisieren und Ihren technischen Stack optimieren möchten, ist die Wahl eines Tools zur Gehaltsabrechnung mit integrierten Funktionen zur Mitarbeiterunterstützung ideal. Diese Art von Lösungen wurde unter Berücksichtigung der Mitarbeitererfahrung entwickelt und hilft den Personenteams, strategischer zu arbeiten.

Skalierbarkeit

Denken Sie über die Funktionen nach, die Ihr HR-Team jetzt benötigt und die, die Sie vielleicht später benötigen. Einführung einer Software, die aktuellen und zukünftigen Anforderungen gerecht wird — zum Beispiel durch modulare Angebote — macht Ihre Investition zukunftssicher und verhindert eine komplizierte Software- (und Daten-) Migration in der Zukunft.

Sicherheit und Datenschutz

Die Gehaltsabrechnungssoftware hostet sensible Mitarbeiterinformationen und Unternehmensdaten. Stellen Sie also sicher, dass die Lösung Ihrer Wahl strenge, transparente Sicherheitsstandards und Konformitätszertifizierungen wie ISO 27001:2022.

Wahl zwischen internen, ausgelagerten und PEO-Gehaltsabrechnungslösungen

Es gibt drei Hauptansätze für das Gehaltsabrechnungsmanagement. Sie können sich für eine interne Lösung entscheiden (mithilfe von Gehaltsabrechnungssystemen und -technologien), diese auslagern oder eine professionelle Arbeitgeberorganisation (PEO) wählen, die sich in Ihrem Namen darum kümmert.

Die interne Gehaltsabrechnung eignet sich am besten für Unternehmen, die über ein HR-Team verfügen, das über die nötige Bandbreite verfügt, um Dinge wie die Vorbereitung der Gehaltsabrechnung, die Verwaltung des Gehaltszyklus und die Berichterstattung zu erledigen. Diese Option bietet maximale Kontrolle und Flexibilität und ist oft kostengünstig, wenn Sie die richtige Software verwenden.

Für Unternehmen, die HR-Teams mit sehr begrenzter Bandbreite haben oder nicht möchten, dass sich ihr internes Team darauf konzentriert Kernprozesse Wie die Gehaltsabrechnung kann Outsourcing eine gute Option sein. PEO eignet sich am besten für Unternehmen, die überhaupt keine Personalteams haben, aber dennoch ihre Mitarbeiter bezahlen und die Steuer- und Compliance-Vorschriften einhalten müssen.

Best Practices für die Gehaltsabrechnung für HR-Teams von heute

Die besten Gehaltsabrechnungsprozesse sind präzise und skalierbar — aber wie genau können HR-Teams das erreichen? Mit diesen Best Practices haben Sie einen guten Start.

Standardisieren Sie Ihre Gehaltsabrechnungsprozesse

Waschen, abspülen, wiederholen. So einfach kann Ihr Gehaltsabrechnungsprozess sein, nachdem Sie mit dem richtigen System iteriert haben. Zum Beispiel Leapsome Gehaltsabrechnung ermöglicht es Personalleitern, individuelle Richtlinien für mehrere Mitarbeitergruppen auf der Grundlage von Faktoren wie geografischem Standort und Steuerpflicht zu zentralisieren und durchzusetzen.

Kommunizieren Sie Ihren Mitarbeitern klar und deutlich die Gehaltsabrechnungsprozesse

Die Mitarbeiter sollten wissen, wie ihr Gehalt berechnet wird, wann sie bezahlt werden und wie Abzüge funktionieren. Abweichungen vom Zeitplan sollten so weit wie möglich vermieden und immer im Voraus mitgeteilt werden, sofern dies unbedingt erforderlich ist. Wie bereits vorgeschlagen, sollten Sie erwägen, eine Lösung mit Self-Service-Funktionen einzuführen, damit die Teammitglieder selbstständig auf diese Informationen zugreifen können.

Implementieren Sie ein skalierbares Gehaltsabrechnungssystem

Mehrfach Entgeltstrukturen? Neue Anforderungen an Überstunden, die es zu verfolgen gilt? Eröffnung eines Büros in einem neuen Land? Kein Problem. Die richtige Gehaltsabrechnungssoftware kann sich an Ihre wachsenden Geschäftsanforderungen anpassen, ohne etwas zu verpassen.

Nutzen Sie KI und Automatisierung

Die Automatisierung von Gehaltsabrechnungen, Steuererklärungen und Konformitätsprüfungen reduziert menschliche Fehler und spart Zeit. KI-gestützte Erkenntnisse können HR-Teams auch dabei helfen, Gehaltsabrechnungstrends zu erkennen und zu optimieren Vergütungsstrategien — zum Beispiel, indem wir helfen, Mitarbeiter zu identifizieren, für die eine erhebe oder die Beseitigung potenziell nachteiliger Lohnunterschiede.

Das Gehaltsabrechnungstool, das für die HR-Teams von heute entwickelt wurde

.png)

Die Gehaltsabrechnung ist ein vielschichtiger und oft komplexer Prozess. Aber mit die Recht Werkzeugkasten, es Dose Verwandeln Sie sich von einem Kopfzerbrechen in ein Unterscheidungsmerkmal im Wettbewerb.

Bei Leapsome setzen wir uns dafür ein, Tools zu entwickeln, die die Gehaltsabrechnungsstrategie des modernen HR-Teams unterstützen. Unser CHRIS ist gebaut mit Zeiterfassung, Abwesenheits- und Dokumentenmanagement-Tools, bei denen das Mitarbeitererlebnis an erster Stelle steht.

Leapsomes Lohn- und Gehaltsabrechnung Mit diesem Tool können Sie wichtige Aufgaben wie die Vorbereitung der Gehaltsabrechnung, das Starten von Gehaltsabrechnungszyklen, das Generieren von Berichten, das Verteilen von Gehaltsabrechnungen und den Export von Daten an den Lohnabrechnungsprozessor Ihrer Wahl erledigen. Das Ergebnis? Ein Gehaltsabrechnungssystem, das Sie und Ihre Mitarbeiter lieben.

🦸 Machen Sie die Probleme mit der Gehaltsabrechnung zu einem Problem der Vergangenheit

Mit Leapsome ist es einfach, sich wiederholende, aber aufwändige Prozesse wie die Gehaltsabrechnung zu automatisieren.

👉 Eine Demo buchen

Haftungsausschluss: Dieser Artikel dient nur zu Informationszwecken und bietet keine Rechts-, Steuer- oder Finanzberatung. Obwohl wir unser Bestes getan haben, um Richtigkeit und Vollständigkeit zu gewährleisten, können wir nicht garantieren, dass alles aktuell oder fehlerfrei ist. Für eine maßgeschneiderte Beratung empfehlen wir, einen qualifizierten Anwalt oder Steuerberater zu konsultieren.

Sind Sie bereit, Ihre Strategie zur Mitarbeiterförderung zu verbessern?

your People operations?

Informieren Sie sich über unsere Leistungsbeurteilungen, Ziele und OKRs, Engagement-Umfragen, Onboarding und mehr.

.webp)

.webp)

Fordern Sie noch heute eine Demo an

Fordern Sie noch heute eine Demo an

.png)